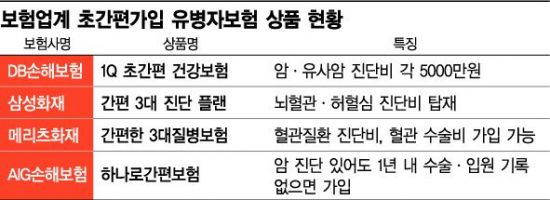

The insurance for the sick is divided into various plans depending on what kind of disease I had and when I was treated. View only diagnosis/hospitalization/surgery history within 5 years View only treatment history within 3 months and surgery/hospitalization history within 1 year 3.1 View only 3 months 3 months 3 months 3 months 3 months 3 months 3 months 3 years 3 days 3 days 3 days 3 days 3 days 3 days 3 days 3 days 3 days 3 days 3 days 3 days 3 days 3 days 3 days 3 days 3 days 3 days 3 days 3 days 3 days 3 days 3 days 3 days 3 days 3 days 3 days 3 days 3 days 3 days 3 months.

The advantages and disadvantages of each company are clearly different, so you will be more satisfied if you prepare for the guarantee with a plan that meets my needs as much as possible^^

Cost-effective warranty design is fundamental.More important is proper compensation coaching.Please see the various compensation cases of the 15th year designer Bob Nam.

What are the criteria for choosing a good insurance planner? By Bobnam Insurance is a long-term product and an economic lifeline for me and my family at the same time in an emergency. So it’s really hard to prepare well prepared. blog.naver.com

.png?type=w800)

What are the criteria for choosing a good insurance planner? By Bobnam Insurance is a long-term product and an economic lifeline for me and my family at the same time in an emergency. So it’s really hard to prepare well prepared. blog.naver.com

Today, we are going to focus on three types of sick person insurance surgery plan, from 3.2.5 plan to 3.3.5 plan and NEW 3.3.5 plan from D company, which is traditionally reputed to have a good guarantee of surgical expenses.In addition, I’d like to introduce you to Company L’s 3.2.5 plan for surgery for the sick.診断 If you want to receive a guarantee focusing on the cost of diagnosis, you can choose the most suitable plan according to your age, gender, and occupation.

a man of forty

a woman of forty

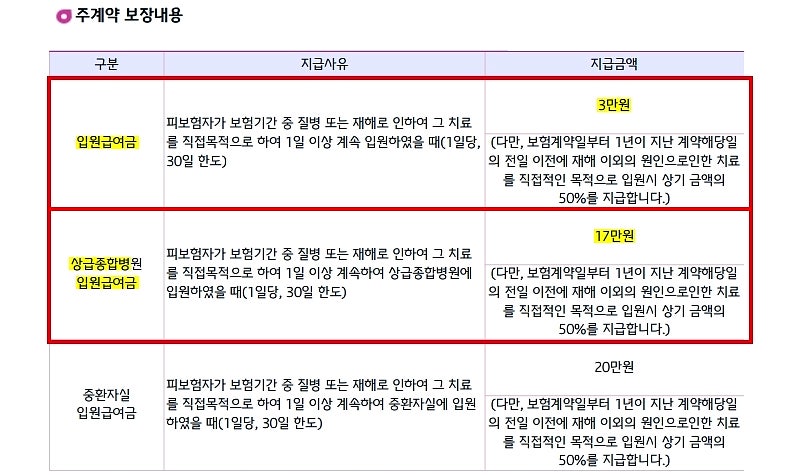

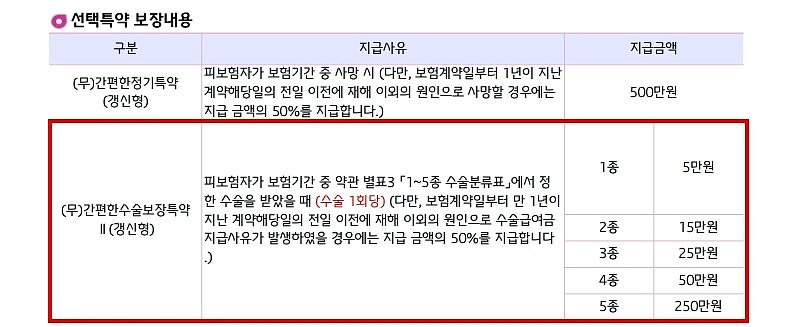

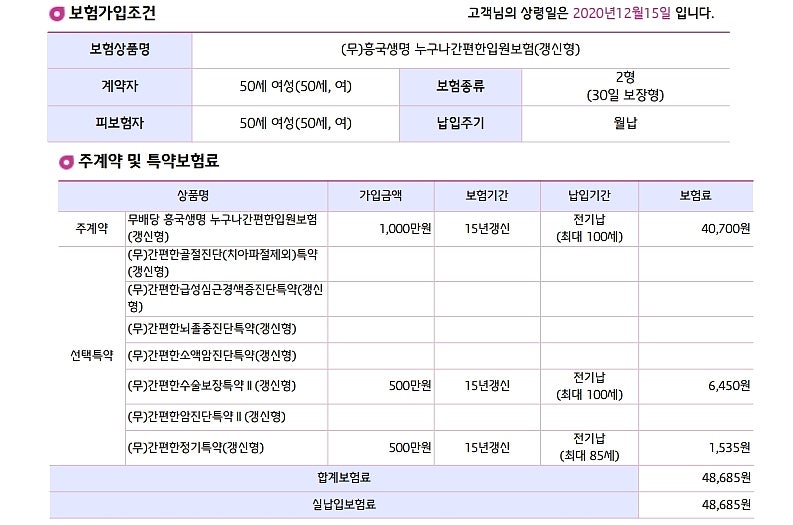

All design documents are 90 years old, 20-year-old maturity payment/cancellation refund unpaid (no resolution) based on 40-year-old women 1.D Company 3.2.5 Plan

By the way, Company L has excellent competitiveness for 3.2.5 surgery costs.

Simplified examination 335 Serious increase LOTTE DADAM is cheaper than insurance for the sick – 3 major diagnosis costs (cancer, cerebrovascular, ischemic) #335 Simplified examination #325 for the sick person’s cerebrovascular examination is cheaper than 325…blog.naver.com

Company D has to match the scoring.

What I mean is that if the total insurance premium accounts for more than 40 percent of the total cost of surgery, you have to adjust the score to a special contract per day for injury death/disease death/severe patient hospitalization.In other words, if the three major diagnostic costs (cancer, brain, heart) are configured together, there is no particular difficulty in scoring, but if the cost of surgery is centered on the above design, the minimum insurance fee is over 50,000 won.However, the 3.3.5 plan is often more cost-effective for H than for D (especially for women).Hyundai Marine 333 Simplified Examination Health Insurance Non-renewable Launch #Medium Discounted Affected Persons Insurance #333 Simplified Examination For the first time in Hyundai Marine, the cheapest “Medium Discounted Convenience…” blog.naver.comHyundai Marine 333 Simplified Examination Health Insurance Non-renewable Launch #Medium Discounted Affected Persons Insurance #333 Simplified Examination For the first time in Hyundai Marine, the cheapest “Medium Discounted Convenience…” blog.naver.comIt was 51,226 won when cancer (similar cancer) was added 4 million won to 3.2.5, but 51,666 won (because 335 is cheaper than 325), if cancer is raised from 3.2.5 to 8 million won, 60,694 won will be about 10,000 won higher than plan.It consists of 1-5 types of surgery costs that are repeated every time, which is the exclusive damage of Company D.The special contract for disease surgery can be repeated every time, but since the special contract for repeated disease surgery is quite expensive every time, the special contract for disease surgery, which is paid once a year for each same disease, was effectively reflected.3. Company D’s NEW 3.3.5 PlanAccording to the history of simple health insurance (hypertension, hyperlipidemia, diabetes, 7 or more consecutive visits, etc.) that can be collected even if there is a history of hospitalization surgery within 3 years…blog.naver.comThe new 3.3.5 plan is a plan that does not ask the operation history, so the guarantee limit of the operation fee is slightly reduced compared to the previous 335.In addition to the cost of one to five types of surgery, the limit is set, so if you remove the cost of one to five types of surgery, you can increase the cost of the three types of surgery.For the same reason, you can pay up to 200,000 won for surgery for 69 major lifestyle diseases (up to 500,000 won is possible under the existing 335 plan). NEW 3.3.5 sick insurance is currently only available at D and H companies.Medium premium sick insurance H & D private sick insurance that can be guaranteed at a low price even if there is a lot of surgery history within 3 years. The tighter the obligation (notice) before the contract, the cheaper and the more flexible it is. Commonly ill… blog.naver.comCompany D’s operating expenses benefit from 119 major disease operating expenses.Heart failure and arrhythmia, which cannot be guaranteed by ischemic surgery costs, can be guaranteed up to 10 million won by 119 major surgery costs (disease in their 20s).For various types of surgery, the same amount of money is guaranteed without distinction between coronary and non-collateral surgery.If you are not eligible for 3.3.5, but can only prepare for 3.2.5, I told you that Company L is highly competitive. In 3.2.5, I will show you this table by comparing the cost of surgery between Company D and Company L.In the case of Company L, the cost of surgery for one to five types of diseases is high (20,000 won for one type and two types), and the cost of surgery for minor diseases such as colon polyps is higher than that of Company D.Therefore, when 3.2.5 is the only guarantee preparation, preparing D and L together is also a way to secure a high-quality special contract for surgery. 4. The disappointment of L and 3.2.5-L is that they don’t have a 3.3.5 plan, but 3.2.5 is very competitive.And the biggest advantage is that I can design only the cost of surgery that I want without having to match the special scoring.Therefore, if you want to guarantee a high level of surgery costs with “disease insurance,” it is also good to prepare a combination of D and L companies.The biggest advantage of L’s special contract for surgery is that the limit of one to three types of surgery is higher than that of one to five types of diseases, and the second is that 34 and 64 units of specific disease surgery can be included.Company L 34 unitsCompany L 64 unitsThus, I will end the posting with D’s various types of surgery plan designers, analyzing the cost guarantee of L company with good cost performance in 3.2.5.The scorching heat has begun.Everyone, please take care of your health^^Click to communicate with Bob Nam.Press and talk to Bob Nam.Press and talk to Bob Nam.